Challenge

There are many variables to be considered, and a lot more data sources to integrated with in order to:

- Analyse User Behavior Analysis

- Develop Natural Language Processing (NLP) models

- Real-time Transaction Monitoring

- Anomaly Detection

- Machine Learning Model Adaptation/Evolution

- User Education and Feedback Integration

Approach

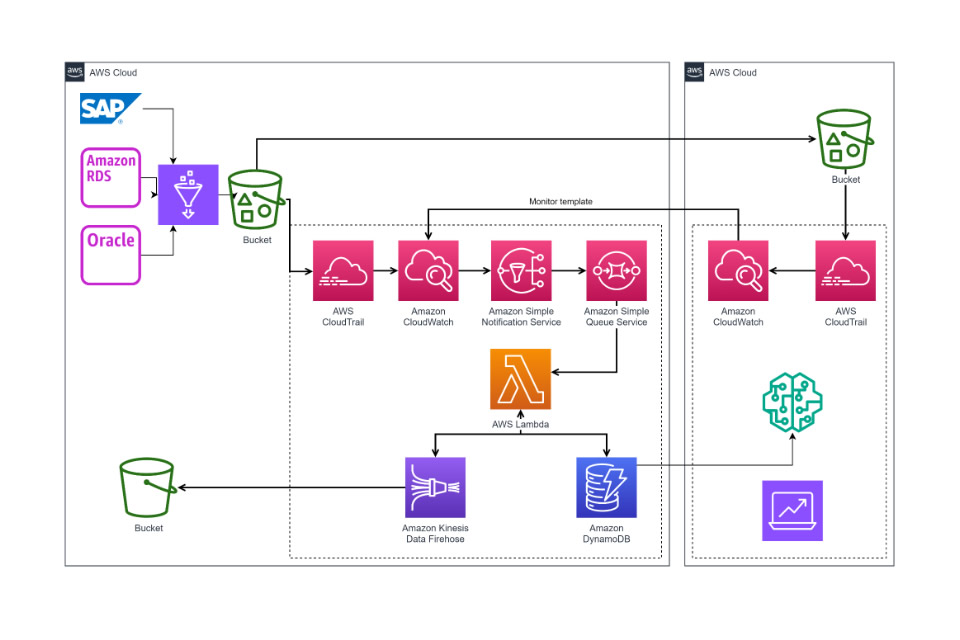

Harvest information from transactional systems against data lake:

- Extract data from transactional systems

- Apply data anonymization and cleaning

- Apply data transformations to perform aggregations, time series analysis and additional features

- Developed custom AI/ML models to detect fraud.

- Continuous evaluation of model performance to be retrained frequently to avoid decay

Value Delivered

- Enhanced Security: Provides robust protection against a wide range of impersonation scams, safeguarding users’ financial assets and personal information.

- Improved User Trust: Increases confidence in online banking applications, encouraging the use of digital banking services.

- Reduced Fraud Losses: Minimizes financial losses due to fraud, protecting both the users and the financial institutions.

- Adaptive Fraud Detection: Keeps pace with evolving scam tactics, ensuring long-term resilience of online banking platforms against impersonation scams.

- User-Centric Approach: Balances security measures with user convenience, ensuring that fraud prevention does not impede the banking experience.

Cloud Experts

Guidance and hands-on-keyboard through your cloud journey, from migration to AI in production

Head Office

Rua Ramalho Ortigão 213

4900-422 Viana do Castelo

Portugal

Phone: +351 258 121 902 (Call to national fixed network)

Mobile: +351 964 367 684 (Call to national mobile network)

Email: account@valuedate.pt